Planning the Trade Based on Scanners

The above scanners are only a handful of potential alerts and filters that you can set up with Trade Ideas software or the many other scanner service providers. There are millions of traders out there and no doubt almost every one of them swears by a scan they have defined - and have redefined and tweaked over time! In this book, I introduce the simplest yet effective scans that have worked best for me, my personality and my account size. I’ve found that they work very well for the traders in our community, as well as for my own personal trading. For example, I decided to stop sharing with our chatroom my VWAP Breakout Scanner, but a few of our traders then emailed me and asked for it. I rarely make any trades based on that scanner, but apparently some of our traders were making “easy” money off of it! Please read the January 17, 2018 email from Trader Nick to me, a screenshot of which appears as Figure 3.29:

“Good evening Andrew,

“Thanks for bringing back the VWAP False breakout scanner. I remember back (July 2017) in the day I would always trade off that scanner from 9:45 to 10:20 and be done for the day with easily 1k profits. I'm sure many traders are new here and haven't experience[d] this great scanner. Is there any way you could add a line or two of the false breakout scanner to your screen[?] I'm sure many people will benefit from this scanner. Also, see you in chat tomorrow.

“Thanks for everything.”

Figure 3.29 - Nick’s email requesting the return of the VWAP Breakout Scanner.

My preference for trading is to carefully monitor the Stocks in Play that I shortlist on my Gappers watchlist. Because these stocks are selected before the market Open, I have sufficient time to review their charts, daily levels and observe their price action before the market Open. At the Open, I constantly monitor their charts and try to plan a trade based on the strategies detailed in Chapter 6. I usually select three to five Stocks in Play and watch them separately on my four monitors. When I see a potential strategy, I plan and execute my trade.

Stocks that hit my real time scanners, on the other hand, are more unknown to me, and I need more time to process their situation before making a trade, which makes it more difficult to trade based on real time scanners. Day trading is a very fast decision-making process. Sometimes you can plan a trade in a few minutes and at other times you have to make a decision in just a few seconds. This is why you need months of training in simulator accounts to well understand the decision-making process.

If you require a reminder of the importance of patience in trading, here it is. There are plenty of traders out there who are making the error of overtrading. Overtrading can mean trading twenty, thirty, forty, or even sixty times a day. You’ll be commissioning your broker to do each and every one of those trades, so you are going to lose both money and commissions. Many brokers charge $4.95 for each trade, so for forty trades, you will end up paying $200 per day to your broker. That is a lot. If you overtrade, your broker will become richer, and you will become, well, broker! Remember, your goal is to trade well, not to trade often.

Another problem with overtrading is risk. While you're in a trade you are exposed to risk, and that’s a place you don’t want to be in unless you have proven that there is a setup in the strategy worth trading.

The stock market is controlled by machines and highly sophisticated algorithms and, as a result, there is considerable high frequency trading. High frequency trading creates significant noise in the price action and is specifically designed to shake out retail traders like you and me. You must be smart. Don’t expose yourself to them. Profitable traders usually make only two or three trades each day. They then cash out and enjoy the rest of their day.

Whenever a stock hits my scanners, I then check it in my trading platform and decide, based on my strategies set out in Chapter 6, if I want to trade it or not. Remember, just because a stock hits my scanners does not mean I blindly trade it. A scanner alert gets my attention, but I don’t necessarily make a trade. Like a guerrilla trader hiding in the jungle, I watch the stock and look for a trading opportunity. I have yet to define a scanner that gives me a 100% tradeable alert, and I don’t think such a scanner really exists, at least for us retail traders. As an aside, just in case you have not come across the term before, guerrilla trading is like guerrilla warfare, you wait for an opportunity to move in and out of the financial battlefield in a short period of time to generate quick profits while keeping your risk to a minimum.

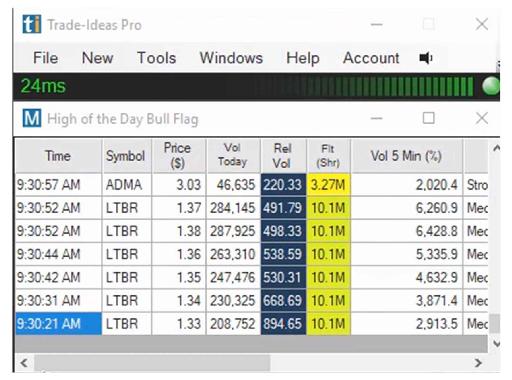

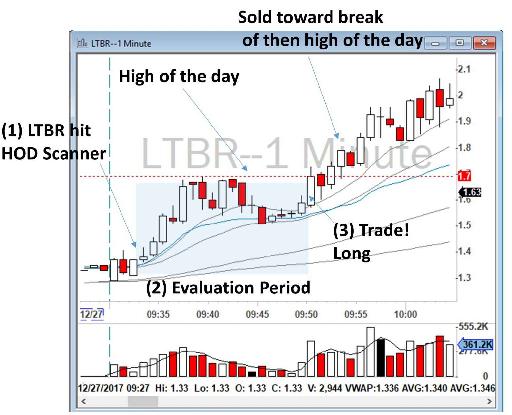

An example of this process can be seen in a trade that I made on December 27, 2017. Lightbridge Corporation (ticker: LTBR), a low float stock of only 10 million shares, hit my scanner right at the Open at 9:30:21 a.m., as shown in Figure 3.30. LTBR was not previously on my Gappers watchlist nor Top List and I had no plan to trade it before the market Open. When it hit my scanner right at 9:30:21 a.m., I quickly checked the chart, volume and price action and realized it might provide a trading opportunity. I quickly looked at its daily chart and found a $1.70 level. However, I waited until I could find an excellent entry. Figure 3.31 illustrates this process and you will see where I marked my trade on LTBR. Figure 3.32 is a screenshot of my profit and loss (P&L) for this day of trading.

Figure 3.30 – LTBR hits my scanner 21 seconds after market Open.

Figure 3.31 - Process of a trade on LTBR after it hit my scanner.

You’ll notice that my evaluation period was almost 20 minutes. I was patiently watching LTBR and looking for a good entry. Day trading can be a boring profession – most of the time you are just sitting and watching your monitors. In fact, if day trading is not boring for you, then you are probably overtrading.

Figure 3.32 - My P&L showing the results of my trade on LTBR.

Table of contents

- DISCLAIMER:

- Table of Contents

- Chapter 1: Introduction

- Chapter 2: The Trading Tools and Platform

- Chapter 3: Building Your Trading Watchlist

- Chapter 4: Support and Resistance Levels

- Chapter 5: Price Action, Candlesticks and Trade Management

- Chapter 6: Advanced Day Trading Strategies

- Chapter 7: Risk and Account Management

- Chapter 8: Conclusion and Final Words

- Glossary